PA 529 | College and Career Savings Program

The Pennsylvania 529 College and Career Savings Program offers two 529 plans – the PA 529 Guaranteed Savings Plan (GSP) and the PA 529 Investment Plan (IP) – and sponsors Keystone …

HOW TO ENTER: LIMIT: One (1) entry per PA 529 account, open and funded, and determined to be eligible as explained in the Eligibility section.

Los contribuyentes de Pensilvania pueden deducir las contribuciones de PA 529 de sus ingresos imponibles de Pensilvania hasta $19,000 por año, por beneficiario.

The PA 529 GSP helps you know how much you need to save, and how close you are to your goal, by having you choose a higher education tuition level right up front when you enroll.

Pennsylvania offers a second 529 plan, the PA 529 Guaranteed Savings Plan (GSP), which is designed to help savings grow to meet the future cost of education. When used for qualified education …

For schools that charge a semester rate, the PA 529 GSP Semester Rate is the sum of either 12 or 15 PA GSP Credits, depending on the actual rate set by the school.

Target Enrollment Option - PA 529 College and Career Savings Program

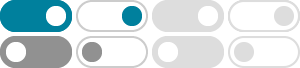

PA 529 IP Target Enrollment Date Portfolios Select a target enrollment date portfolio below to see how its underlying asset allocations change more frequently and gradually away from stocks toward …

Deduct PA 529 contributions up to $19,000 per year, per beneficiary, on your Pennsylvania income taxes, or up to $38,000 per year, per beneficiary for married couples, provided each spouse has an …

Shareholders now have another option to make additional investments by mail for their Pennsylvania 529 Guaranteed Savings Plan (GSP) account. Follow the instructions below and start investing today!

A number of questions exist regarding the requirements that your PA 529 GSP be open for 15 or more years (15 year requirement) and that the contributions and associated earnings must be in the PA …